Introduction

Artificial Intelligence (AI) is today’s gold rush — attracting billions of dollars in investments, partnerships, and infrastructure deals. However, recent viral discussions and visuals circulating online have reignited an important question:

Are we witnessing a genuine revolution — or an AI bubble where money is simply rolling between the same few giants, creating the illusion of exponential growth?

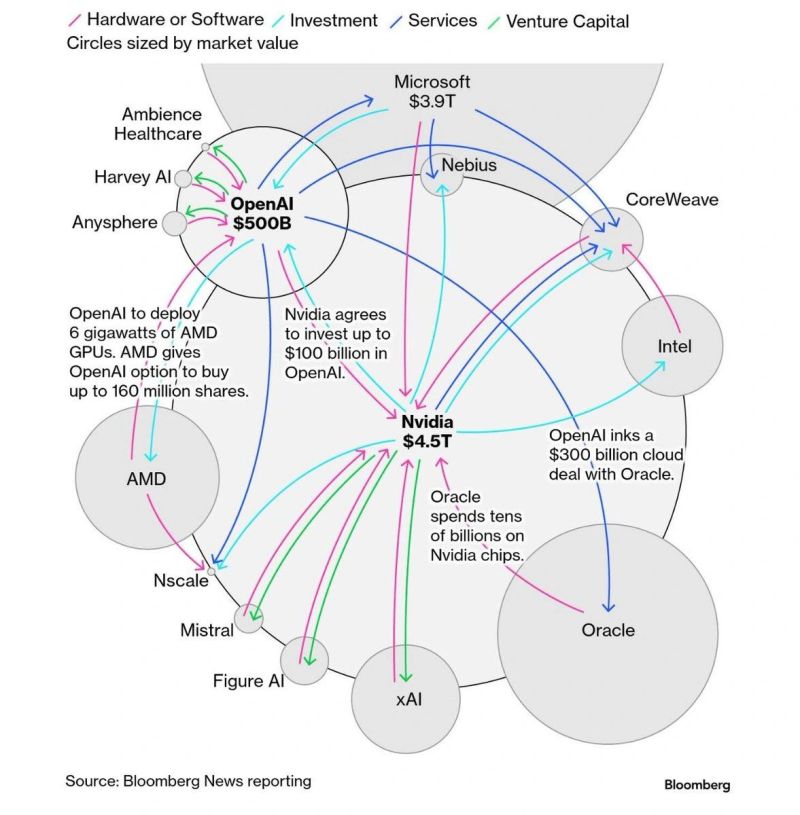

The image that sparked debate highlights a curious loop — Nvidia invests in OpenAI, OpenAI outsources cloud infrastructure to Oracle, and Oracle buys Nvidia’s chips to power those same AI workloads. On paper, it looks like trillion-dollar progress. In practice, it might be the financial equivalent of money passing hands in a circle.

Background: The Players Powering the Loop

1. Nvidia – The AI Hardware Titan

Nvidia, the global leader in GPUs, sits at the heart of the AI economy. Its chips power everything from ChatGPT to autonomous vehicles. Over the past few years, Nvidia’s valuation has skyrocketed — at one point surpassing the combined market cap of Amazon and Google Cloud’s parent company.

Its success stems not only from hardware innovation but also from strategic ecosystem investments — funding AI labs and startups that will, in turn, depend on Nvidia’s chips.

2. OpenAI – The Model Maker

OpenAI, creator of ChatGPT, became the face of generative AI. With multibillion-dollar investments from Microsoft and others, it has built some of the most powerful language models in history. Yet, OpenAI’s operational costs are astronomical — requiring immense cloud infrastructure and GPU compute to train and deploy models.

3. Oracle – The Cloud Enabler

Oracle, once known primarily for databases, has reemerged as a serious AI infrastructure player. Its partnership with OpenAI involves hosting AI workloads on Oracle Cloud, supported by vast data centers packed with Nvidia GPUs.

To meet this demand, Oracle buys billions worth of Nvidia hardware — effectively recycling the same capital that originated from Nvidia’s own ecosystem investments.

Timeline of Key Events

- 2023–2024: Nvidia begins strategic investments in AI startups and model developers, including partnerships with OpenAI and Anthropic.

- Mid-2024: OpenAI signs a multiyear deal with Oracle Cloud, reportedly worth up to $300 billion, to expand compute capacity.

- Late 2024: Oracle orders massive GPU shipments from Nvidia to fulfill its cloud obligations to OpenAI.

- 2025: Analysts and commentators start calling this structure an “AI Money Loop” — suggesting that while turnover is enormous, the actual profit-yielding innovation may not match the capital being circulated.

Why It’s Significant

This ecosystem looks like a closed financial loop:

- Nvidia invests capital into AI developers (like OpenAI).

- OpenAI uses that funding to pay Oracle for compute infrastructure.

- Oracle buys Nvidia chips to power its AI cloud.

- Nvidia profits from Oracle’s purchases — fueling more investment.

It’s an elegant cycle — until one asks whether real, sustainable end-user demand justifies the trillion-dollar commitments.

While each transaction is legitimate, the concentration of power and money among a few companies — Nvidia, Microsoft, OpenAI, Oracle — raises questions about long-term market stability, competition, and valuation accuracy.

The AI Bubble Debate

Economists and analysts have begun to label this trend as a modern AI bubble, akin to the dot-com era of the early 2000s. The warning signs include:

- Skyrocketing valuations not proportionate to revenue.

- Circular cash flows between the same corporations.

- Infrastructure oversupply — data centers built ahead of realistic demand.

- Investor herd behavior, pouring capital into AI without clear monetization models.

However, not everyone agrees. Some argue this is strategic investment, not speculation — a necessary upfront cost to build the infrastructure of the future. Just as the internet required global fiber optics before e-commerce could thrive, AI requires GPU networks and cloud compute before widespread applications can emerge.

Key Lessons for Professionals

1. Follow the Flow, Not the Hype

In emerging industries, revenue numbers can be misleading. Understanding who pays whom and where the money ends reveals the real value drivers — not just the press releases.

2. Infrastructure Investment ≠ Immediate ROI

Building an AI ecosystem involves long payback periods. Businesses investing in AI must prepare for delayed returns, balancing enthusiasm with caution.

3. Diversify Beyond Centralized Giants

With so much capital concentrated in a few companies, opportunities for smaller players exist in niche AI applications, tools, and services that support or complement this infrastructure — rather than compete head-on.

4. Watch for Market Corrections

If user adoption or enterprise integration slows down, the AI hardware and infrastructure sectors could face sudden devaluation. Professionals in AI, finance, and technology must plan for volatility.

5. Innovation Should Outpace Investment

Ultimately, sustainable growth comes from innovation — not the size of the investment loop. Companies and professionals should prioritize building value-creating AI solutions over merely joining the funding frenzy.

Conclusion

The AI industry is undeniably transformative — but its financial ecosystem is beginning to resemble a hall of mirrors. Money is moving faster than innovation, valuations are soaring, and inter-company deals blur the line between investment and spending.

For professionals and investors alike, the lesson is clear: technology revolutions thrive when value creation keeps pace with valuation. Whether this is a bubble or just the infrastructure phase of the next industrial revolution will depend on what comes next — real-world AI applications that justify the hype.